Safety & Security

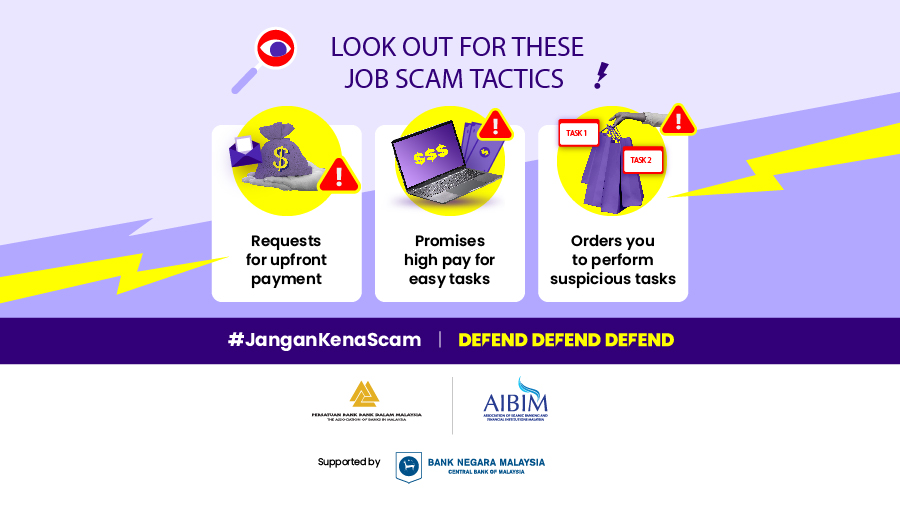

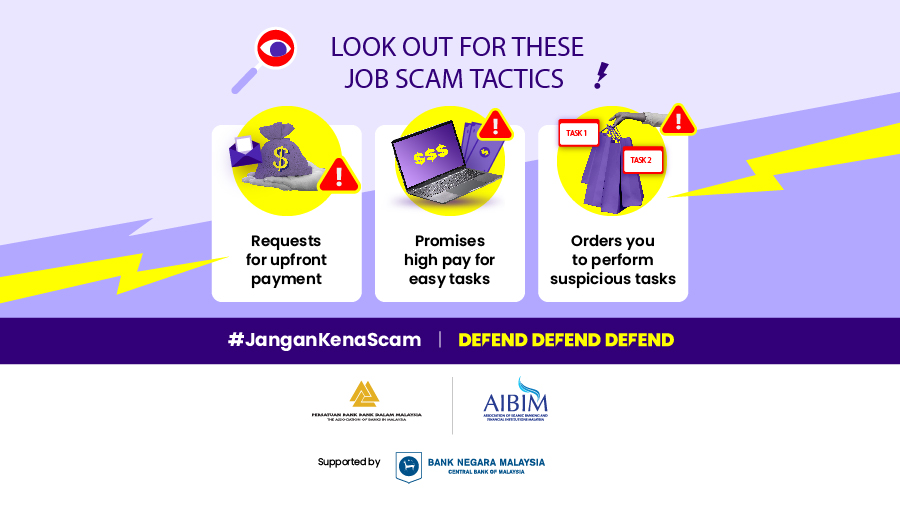

JanganKenaScam | DEFEND DEFEND DEFEND

How to Protect Yourself from Scam!

Do not share your personal details

Only share it with legitimate sources if you consent. Use official channels to verify requests and be cautious of suspicious links or emails. Review app permissions and only grant necessary access.

Protect your device

Use strong passwords and avoid easy-to-guess combinations like '1234' or 'password'. If compromised, change it immediately. Don't root or jailbreak your device, as it can remove security features and leave your device vulnerable to attacks.

Act immediately

if you suspected you have downloaded malicious malware (e.g. APK file). Uninstall any suspicious apps, change passwords, and report suspicious transactions to the police for investigation.

Do not download

application outside of your smartphone's official application platforms (e.g. Google Play Store, App Store)

Safeguard your device from cyber criminals!

Avoid the use of public or open Wi-Fi networks or online or mobile banking. Do not click and download applications from URL sent through unknown SMS / WhatsApp / other messaging services Do not install any app or Android Package Kit (APK) file from unknown source

How to spot SCAM?

Macau Scam

Official business will be done through official channels and usually during office hours. Be wary of calls from private phone numbers claiming that they are persons of authority.

What to look out for?

Calls from authorities using a private number or done after office hours.

Official business will be done through official channels and usually during office hours. Be wary of calls from private phone numbers claiming that they are persons of authority.

Unsolicited calls claiming the you have won a cash/lottery.

The caller will usually request your personal details and banking information in order the “transfer the funds to you”.

Fictitious threats with the intention of making you panic.

Scammers want you to panic so that you are more easily tricked! Here are some examples of fictitious threats: (1) You have unpaid taxes or have committed tax fraud; (2) Your bank account is now frozen or has been hacked; or (3) Your investments proceeds are being withheld temporarily.

Asking you URGENTLY transfer funds to a third-party account.

The scammer will likely demand immediate payment to address the fictitious threat or to safeguard your money.

How to protect yourself from Macau Scam?

What is Mobile Application Scam?

It is when scammers are able to gain access to your phone once you have downloaded suspicious third party applications (e.g. .apk files). Scammers will use this access to read and delete your transaction alerts and/or OTP number.

What to look out for?

Online services or texts (e.g. SMS, Whatsapp, Telegram) asking you to download an application to your phone.

It is when scammers are able to gain access to your phone once you have downloaded suspicious third party applications (e.g. .apk files). Scammers will use this access to read and delete your transaction alerts and/or OTP number.

The application is hosted on non-official site.

Be careful when redirected to suspicious or non-official sites.

How to protect yourself from Mobile Application Scam?

What is Mule Account Scam?

Your bank account is being used by others to either collect or transfer funds. These funds could be stolen or laundered from illegal activities.

If caught, your bank account may be closed and you may face difficulties in opening a bank account in the future. You may also be at risk of being charged with facilitating criminal activities.

What to look out for?

Offer to ‘rent’ your bank account which will then be used to launder/withdraw stolen money.

This can be a face-to-face offer by an unknown party or even by friends or family members. There are also similar advertisements done on social media platforms.

A very lucrative job offer that requires you to hand over your ATM card and/or online banking details.

In exchange for a “too-good-to-be-true” job offer, the application requires you to surrender either your ATM card or details that are usually not required in a job application (e.g. PIN or OTP number, online banking password).

Unlicensed money lenders request for ATM card as collateral during the loan application process.

These money lenders will use your account to collect or transfer funds during this period.

How to protect yourself from Mule Account Scam?

What is Phishing Scam?

It is a fraudulent attempting to trick you to reveal your credentials to the scammer. This can be via links sent via SMS or emails, or fake websites that look just like the real ones.

If you key in your personal information or banking details in these phishing sites, you risk your banking information being stolen by the scammers.

What to look out for?

Suspicious website hyperlinks.

Phishing sites are designed to look like the real ones, with almost an identical online address.

Unsolicited SMS/message/email with clickable hyperlinks..

Phishing sites are designed to look like the real ones, with almost an identical online address.

How to protect yourself from Phishing Scam?

What is Illegal Deposit Taking Scam?

It is the act of receiving, taking or accepting deposits (e.g. money, precious metal) that promises a return or the money’s worth without a valid license under the Financial Services Act (FSA) 2013.

Under Section 137(1) of the FSA, it is an offence for any person to accept deposits without a licence.

There are some exceptions:

1 . Payment of deposit under contract of sale (E.g.: car booking fees)

2 . Security deposit (E.g. house rental deposit)

3 . Payment to government, statutory bodies, approved e-money issuers

What to look out for?

Misuse of Bank Negara Malaysia’s name and logo.

To earn legitimacy, some scammers may furnish letters or certificates claiming that they have been licensed or approved by Bank Negara Malaysia.

No proper documentation.

The financial sector is a regulated industry, with laws, rules and guidelines to protect financial consumers. Be wary of firms that seem “less than professional” (e.g. no receipts, no proper documentation).

Returns that are too good to be true.

Be wary of terms like “guaranteed returns” or returns that are higher than usual without much risks. Usually, it’s a scam.